Skip to main content. The following list provides examples of eligible and ineligible medical expenses.

Read irs publications online in a browser friendly format html.

Weight loss program in irs publication 502 pdf. For a complete list visit irsgov and search for publication 502 medical and dental expenses. Publication 502 explains the itemized deduction for medicaldental expenses claimed on schedule a form 1040 and the health coverage tax credit claimed on form 8885. Publication 584 b 122011 p584bpdf.

Below are two lists which may help determine whether an expense is eligible. For a complete list or further information please refer to irs publication 502 and publication 969 at wwwirsgov. By physician wheelchair wig for hair loss from disease.

A list of these expenses is available on the irs website wwwirsgov in irs publication 502 medical and dental expenses any funds you withdraw for non qualified medical expenses will be taxed at your income tax rate plus 20 tax penalty if youre under 65. It discusses what expenses and. This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a form 1040.

502 such as legislation enacted after it was published go to irsgovpub502. For the latest information about developments related to pub. These rules are subject to change.

Publication 584sp 032019 registro de perdidas por hechos fortuitos imprevistos. Weight loss programs must be to treat a specific disease diagnosed by a physician. Publication 502 2018 medical and dental expenses.

This includes fees you pay for membership in a. Hsa qualified medical expenses. For more detailed information please refer to irs publication 502.

Information about publication 502 medical and dental expenses including recent updates and related forms. Disaster and theft loss workbook. Acupuncture alcoholism treatment ambulance.

Advisor for specific tax advice. Weight loss programs certain expenses if diagnosed. Publication 502 2018.

Payments to participate in a weight loss program for a specific disease or diseases diagnosed by a physician including obesity but not ordinarily payments for diet food items or the payment of health club dues. Payments for insulin and for drugs that require a prescription for its use by an individual. A taxpayers guide on irs policy to deduct weight control treatment from irs publication 502 you can include in medical expenses amounts you pay to lose weight if it is a treatment for a specific disease diagnosed by a physician such as obesity hypertension or heart disease.

Irs code section 213d fsa eligible medical expenses an eligible expense is defined as those expenses paid for care as described in section 213 d of the internal revenue code.

Full Text Hesperidin A Therapeutic Agent For Obesity Dddt

Full Text Hesperidin A Therapeutic Agent For Obesity Dddt

Flexible Spending Account Fsa A Member Guide

Fauquier Resource Guide 2019 20 Piedmont Lifestyle

Fauquier Resource Guide 2019 20 Piedmont Lifestyle

Flexible Spending Accounts Benefits Wellness

Flexible Spending Accounts Benefits Wellness

Tax Deductions For Medical And Oxygen Expenses January

Tax Deductions For Medical And Oxygen Expenses January

Rapid And Reversible Impairment Of Episodic Memory By A High

Rapid And Reversible Impairment Of Episodic Memory By A High

Raspberry Ketone And Garcinia Cambogia Rebalanced Disrupted

Raspberry Ketone And Garcinia Cambogia Rebalanced Disrupted

Hsa Tax Info And Resources Benefits Human Resources

Anti Obesity Therapy From Rainbow Pills To Polyagonists

Hsas For Dummies 2nd Connectyourcare Special Edition

Irs Qualified Medical Expenses

High Deductible Health Plans Human Resources Department

High Deductible Health Plans Human Resources Department

Page 1 Of 4 Medical Expense Reimbursement Plan Information

Page 1 Of 4 Medical Expense Reimbursement Plan Information

Pdf The Effect Of Meal Replacements High In

Pdf The Effect Of Meal Replacements High In

Tax Deductible Weight Loss Program Save Money While Saving

Tax Deductible Weight Loss Program Save Money While Saving

Foreign Direct Investment In Latin America And The Caribbean

Foreign Direct Investment In Latin America And The Caribbean

Pdf Lipid Profile And Some Hormonal Disorders In Serum Of

Pdf Lipid Profile And Some Hormonal Disorders In Serum Of

Flexible Spending Account Enrollment Guide

Insulin Substrate Receptor Irs Proteins In Normal And

Glutamine Regulates Cardiac Progenitor Cell Metabolism And

Glutamine Regulates Cardiac Progenitor Cell Metabolism And

Can I Pay Weight Loss Expenses With My Hsa Aol Finance

Can I Pay Weight Loss Expenses With My Hsa Aol Finance

How To Claim The Medical Expense Deduction On Your Taxes

How To Claim The Medical Expense Deduction On Your Taxes

Research Articles The Health Press Zambia

List Of Hsa Health Fsa And Hra Eligible Expenses

List Of Hsa Health Fsa And Hra Eligible Expenses

High Intensity Interval Training Promotes Total And Visceral

The Mystery Of The Ketogenic Diet Benevolent Pseudo

A Guide To Maximizing Your Healthcare Tax Deductions

A Guide To Maximizing Your Healthcare Tax Deductions

Health Savings Account Handbook

Revenue Impact Of Arizona S Tax Expenditures Fy 2007 08

Revenue Impact Of Arizona S Tax Expenditures Fy 2007 08

Aetna Healthfund Hdhp And Aetna Direct Plan

Cigna Choice Fund Health Savings Account

Bigger Better Together Bigger Better Together

Bigger Better Together Bigger Better Together

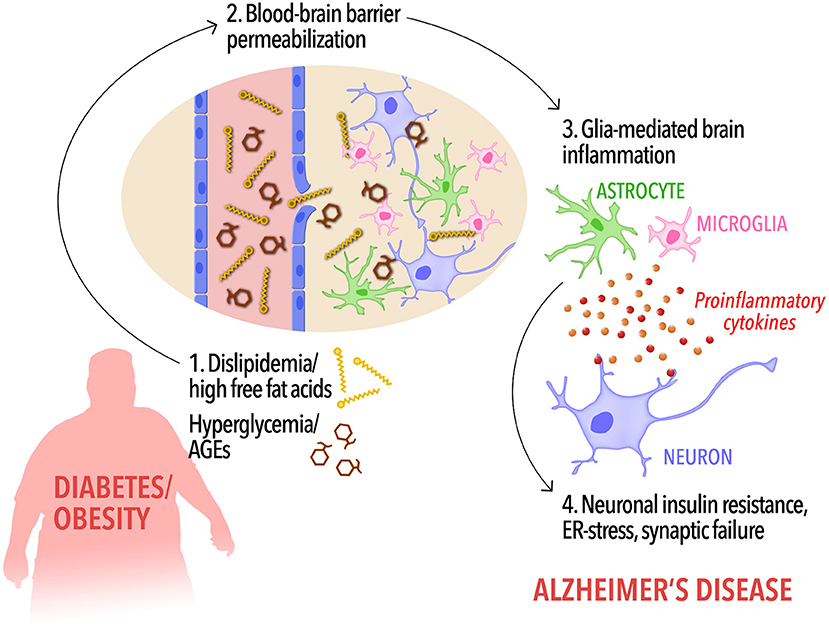

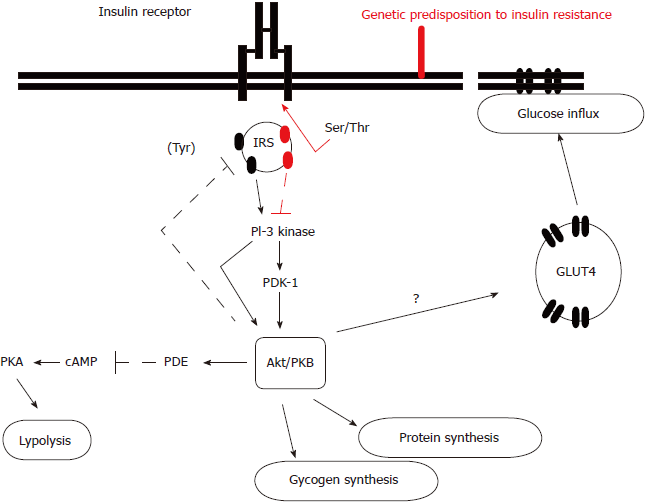

Frontiers Insulin Resistance In Alzheimer S Disease

Frontiers Insulin Resistance In Alzheimer S Disease

Qualified Medical Expenses Funds In Your Hsa Can Be

Sage Books Accounting Theory Conceptual Issues In A

Federal Register Medicare Program End Stage Renal

Federal Register Medicare Program End Stage Renal

Congress And Program Evaluation An Overview Of Randomized

Congress And Program Evaluation An Overview Of Randomized

High Intensity Interval Training Promotes Total And Visceral

Obesity And Gut Microbiota What Do We Know So Far

Flexible Spending Account Enrollment Guide

Personal Trainer Tax Deduction Insurance Letter Of Medical Necessity

Personal Trainer Tax Deduction Insurance Letter Of Medical Necessity

Hess Hypnosis Irs Tax Credit Tampa St Petersburg Florida

The Northern Miner January 21 2019 Issue By The Northern

The Northern Miner January 21 2019 Issue By The Northern

Aminoacyl Trna Synthetases As Potential Drug Targets Of The

Aminoacyl Trna Synthetases As Potential Drug Targets Of The

How To Deduct Medical Expenses Under New Tax Law

How To Deduct Medical Expenses Under New Tax Law

Majority Issn Medical Journal Of Lampung Volume 4 Nomor 7

Majority Issn Medical Journal Of Lampung Volume 4 Nomor 7

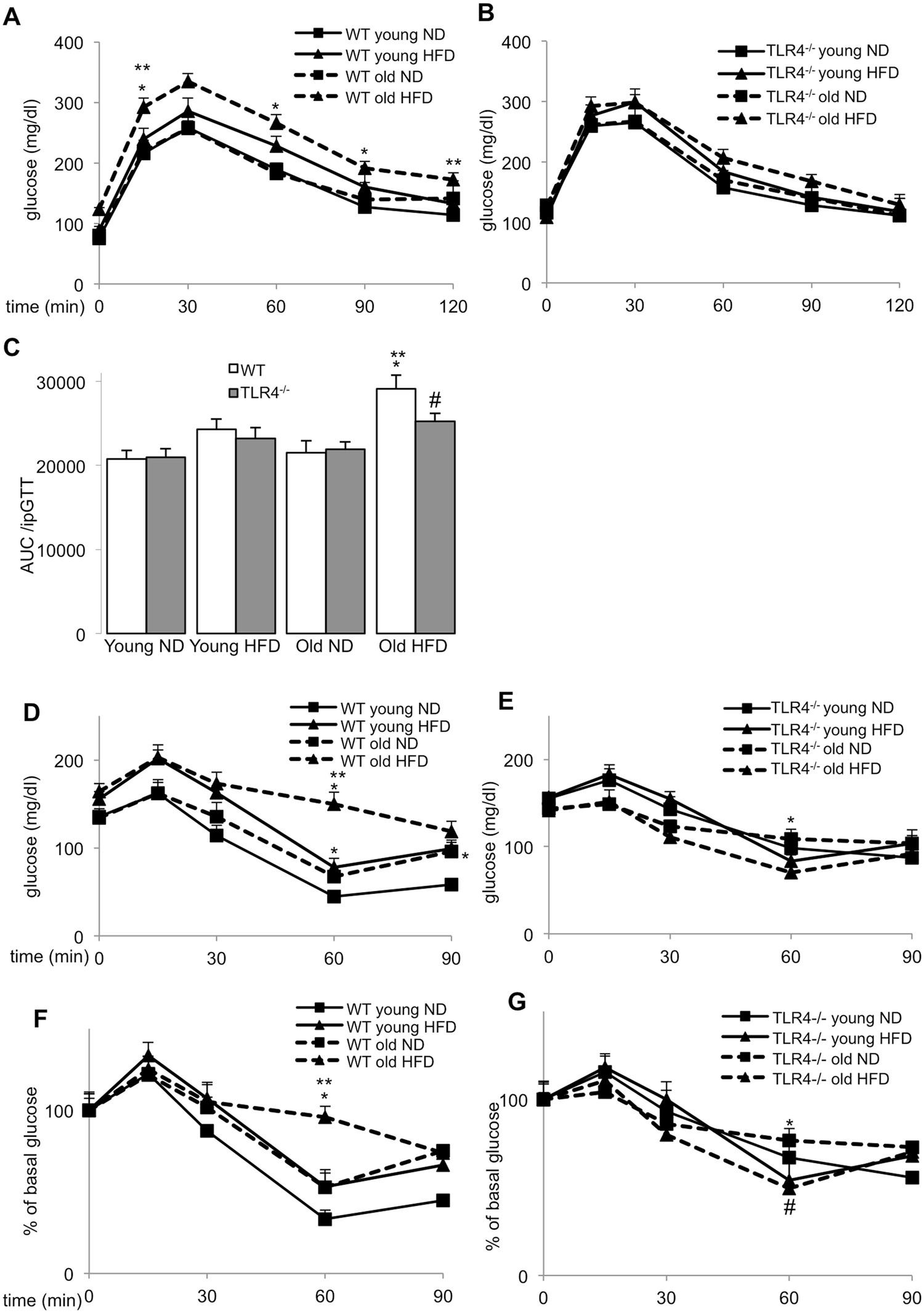

Ageing Potentiates Diet Induced Glucose Intolerance B Cell

Ageing Potentiates Diet Induced Glucose Intolerance B Cell

Boeing Centers Of Excellence Faq

Detailed List Of Eligible Fsa Expenses Pdf Free Download

Detailed List Of Eligible Fsa Expenses Pdf Free Download

Full Text The Beneficial Effects Of Metformin On Cancer

Full Text The Beneficial Effects Of Metformin On Cancer

Icrisat Research Program Publications 2014

Icrisat Research Program Publications 2014

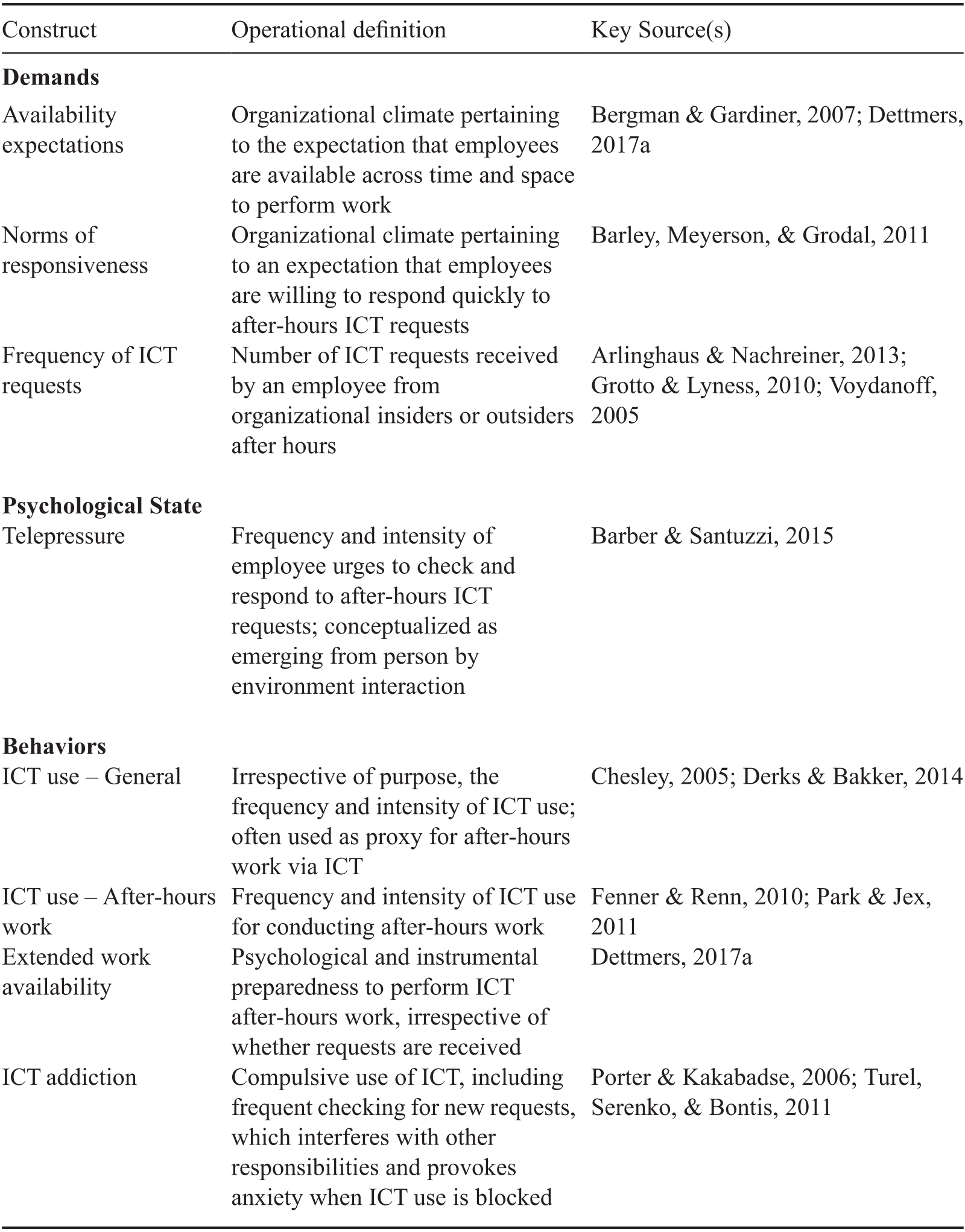

Technology In Motivation And Performance Part V The

Technology In Motivation And Performance Part V The

Deductible Medical Expenses Don T Miss A Single Tax Break

Deductible Medical Expenses Don T Miss A Single Tax Break

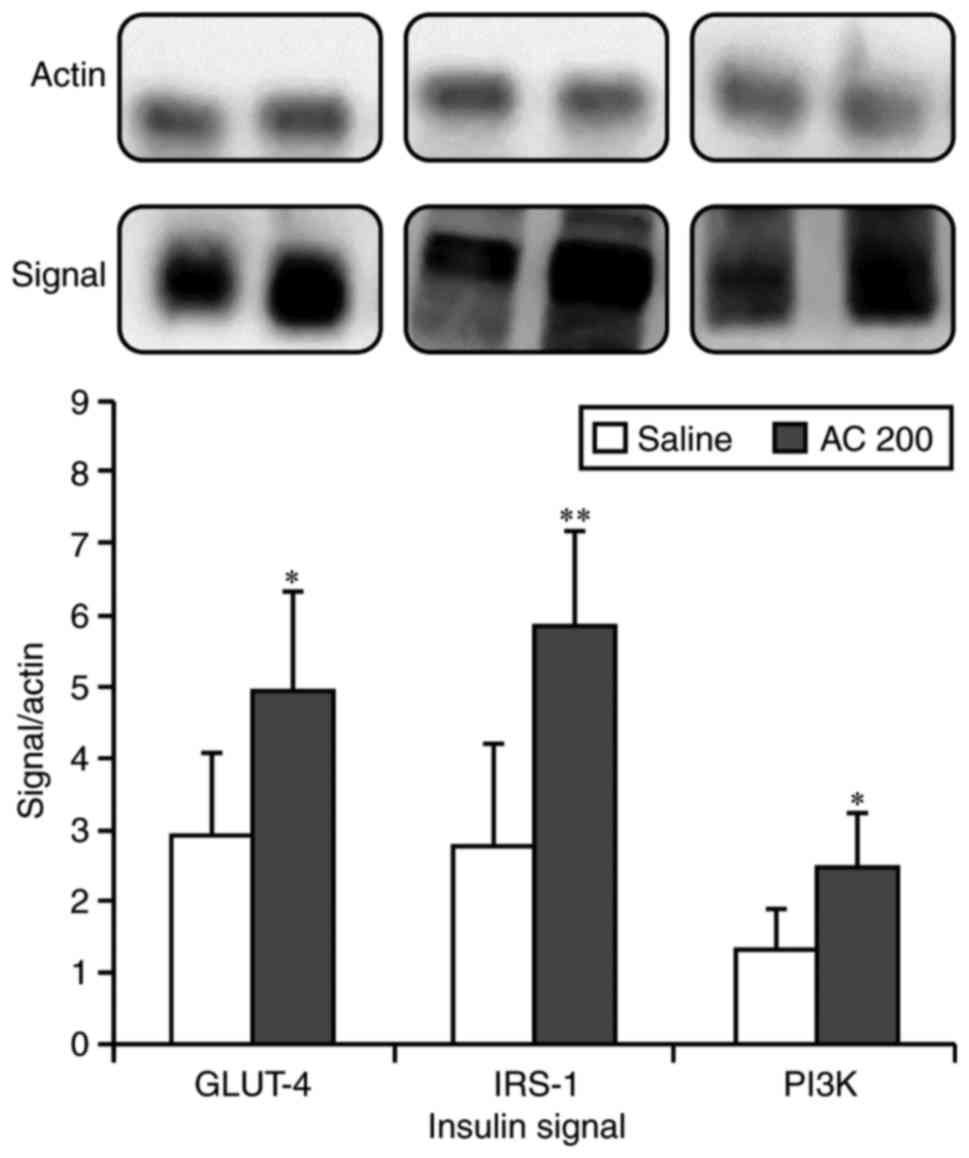

Improving Insulin Resistance With Antrodia Cinnamomea

Improving Insulin Resistance With Antrodia Cinnamomea

Pensacola State College Employee Benefits

Pensacola State College Employee Benefits

How To Set Up A Health Flexible Spending Arrangement

How To Set Up A Health Flexible Spending Arrangement

Commission Regulation Eu No 1321 2014 Of 26 November 2014

Publication 463 2018 Travel Gift And Car Expenses

Publication 463 2018 Travel Gift And Car Expenses

Accompanying Document To The Guidelines For Public Debt

Accompanying Document To The Guidelines For Public Debt

Health Flexible Spending Account

Treatment Approach To Type 2 Diabetes Past Present And Future

Treatment Approach To Type 2 Diabetes Past Present And Future